Payment Switch by Haodatech

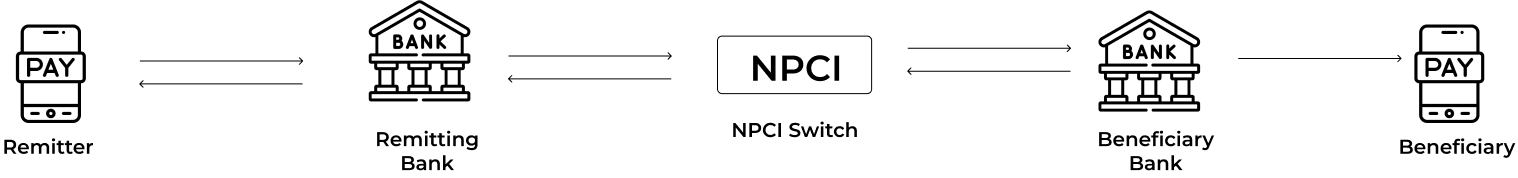

Aligned with NPCI’s IMPS, our IMPS Switch seamlessly integrates bank data with the NPCI switch, ensuring smooth, uninterrupted payments. Powered by cutting-edge technology, it offers a complete end-to-end solution, including development, AMC, and FMS. Trusted by India’s largest public sector banks, RRBs, and private sector leaders.

Our IMPS Services

ASP Model

Cloud-Hosted Solution

TSP Model

Bank-Hosted Solution

Payment Switch by Haodatech

Aligned with NPCI’s IMPS, our IMPS Switch seamlessly integrates bank data with the NPCI switch, ensuring smooth, uninterrupted payments. Powered by cutting-edge technology, it offers a complete end-to-end solution, including development, AMC, and FMS. Trusted by India’s largest public sector banks, RRBs, and private sector leaders.

Our IMPS Services

ASP Model

Cloud-Hosted Solution

TSP Model

Bank-Hosted Solution

High TPS Through Microservices

Our solution ensures high transactions per second, leveraging microservices architecture.

Omnichannel Experience

Seamless integration across Mobile Banking, Internet Banking, and Branch IMPS.

Additional Channels

Supports Foreign Inward Remittance and Business Correspondent (BC) Points.

Guaranteed Safety and Security

Complete encryption ensures maximum security for all transactions.

Real-Time Monitoring and Alerts

Provides real-time transaction monitoring and instant alerts to identify and respond to anomalies swiftly.

Scalable and Flexible Infrastructure

Built on a scalable architecture that adjusts to your organization’s growth and changing needs without compromising performance.

Advanced Fraud Detection

Incorporates AI-driven algorithms to detect and prevent fraudulent activities, ensuring secure and reliable transactions.

Comprehensive Reporting and Analytics

Offers robust reporting tools and analytics for insightful decision-making and regulatory compliance.

IMPS is headed

one way… up!

From e-commerce to kirana stores, IMPS is growing in popularity. Accelerated by the pandemic, it has taken over the digital payment economy and is rapidly increasing its footprint. According to estimates, digital payments in India are expected to hit $2.15 trillion in FY22. Of these, IMPS is expected to contribute to 50% of total payments. IMPS has seen an 81% growth in volumes in 2020 and 103% in 2021.

The numbers are clear. IMPS is not only here to stay but also increasing in terms of adoption and usage owing to its convenience and accessibility.

Ride the IMPS

wave today

Faster go-to-market speed, reduced costs, increased brand equity. Let’s get you the best IMPS APIs in the market!

Why Us?

Lightning-Fast Money Transfers

Experience rapid money transfers at the speed of thought.

Multi-Channel Support

A comprehensive solution that supports Mobile Banking, Internet Banking, ATMs, Business Correspondents, Branches, and Foreign Inward Remittance.

Instant Transfer and Settlement

Enjoy immediate transfer and settlement of funds.

Transaction Alerts

Prompts and notifications keep both sender and receiver informed of transaction status.

IMPS Transaction Flow